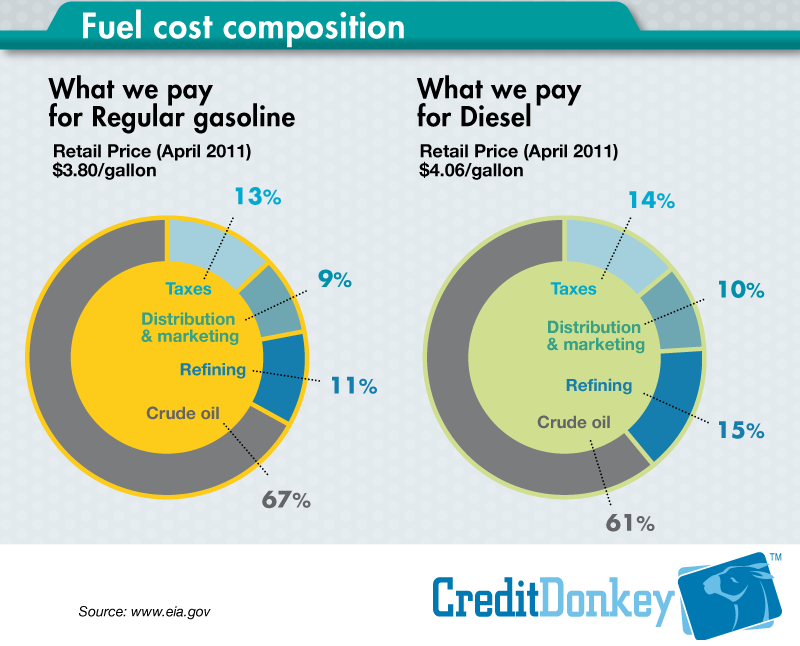

Breakdown of Gas Prices

- Taxes: 13 cents

- Distribution and Marketing: 8 cents

- Refining: 14 cents

- Crude oil: 65 cents

This is what the average breakdown looked like in April 2011. Let's look at those components in more detail.

- Crude oil - The biggest portion of the cost

of gas goes to the crude-oil suppliers. This is determined by the

world's oil-exporting nations, particularly the Organization of the

Petroleum Exporting Countries (OPEC), which you will learn more about in

the next section. The amount of crude oil these countries produce

determines the price of a barrel of oil. Crude-oil prices averaged

around $35 per barrel (1 barrel = 42 gallons or 158.99 L) in 2004. And,

after Hurricane Katrina, some prices were almost double that. In April

2008, crude-oil prices averaged around $104.74 per barrel. During that

month, the price of oil reached a record price of almost $120 a barrel

[source: DOE]. By May 16, prices had topped $117 per barrel [source: MarketWatch].

On May 22, markets in New York and London reported prices past $135 per

barreland, and on July 11, oil hit an all-time high of $147 [source: Forbes, New York Sun].

Analysts speculated that everything from investment in oil futures to

increasing demand from countries like India and China contributed to the

spike in price.

Sometimes, gas prices go up even though there is plenty of crude oil on the market. It depends on what kind of oil it is. Oil can be classified as heavy or light, and as sweet or sour (no one actually tastes the oil, that's just what they call it). Light, sweet crude is easier and cheaper to refine, but supplies have been running low. There's plenty of heavy, sour crude available in the world, but refineries, particularly those in the U.S., have to undergo costly retooling to handle it.

- Refining costs - The cost of refining diesel

fuel can be considerably higher than the price of refining regular

gasoline. To learn more about oil refining, read How Oil Refining Works.

- Distribution and marketing - Crude oil is

transported to refineries, and gasoline is shipped from the refineries

to distribution points and then to gas stations. The price of transportation is passed along to the consumer. Marketing the brand of the oil company is also added into the cost of the gasoline you buy.

- Taxes - Federal and state governments each

place excise taxes on gasoline. There may also be some additional taxes,

such as applicable state sales taxes, gross receipts taxes, oil

inspection fees, underground storage tank fees and other miscellaneous

environmental fees. Add that to the state excise taxes, and it can

average 27.4 cents. It could be worse. In Europe, gas prices are far

higher than in America because taxes on gas are much higher.

- Station markup - Of course some of the money you spend at the pump does go to the service station. While some consumers blame high prices on station markup, service stations typically add on a few cents per gallon. There's no set standard for how much gas stations add on to the price. Some may add just a couple of cents, while others may add as much as a dime or more. However, some states have markup laws prohibiting stations from charging less than a certain percentage over invoice from the wholesaler. These laws are designed to protect small, individually-owned gas stations from being driven out of business by large chains that can afford to slash prices at select locations.

Average U.S. Gasoline Prices

| ||||||||||||||||||||||||||||||||

World events, wars and weather can also raise prices. Anything that affects any part of the process, from the moment the oil is drilled, through refining and distribution to your car will result in a change in price. Military conflicts in parts of the world with lots of oil supplies can make it difficult for oil companies to drill and ship crude oil. Hurricanes have damaged offshore drilling platforms, coastal refineries and shipping ports that receive oil tankers. If a tanker itself is lost or damaged, or leaks its oil into the ocean, that will put a dent in the market as well.

What Causes Gasoline Prices to Fluctuate?

Have you ever wondered who’s at the throttle of the gasoline-price rollercoaster for the past several years?With the price of gasoline having peaked at more than $4 per gallon in some areas, then falling to less than $2, it’s hard for consumers to understand – not to mention budget for.

The factors that determine the final price of gasoline are far-reaching and global – from local politics in developing nations to a natural disaster in a neighboring state. Other elements come into play as well.

Factors that influence gasoline prices

Supply of crude oil – Most crude oil that’s refined into gasoline is produced and sold by Oil Producing Exporting Countries – or OPEC. This cartel of 12 countries in Africa, the Middle East and South America uses a loose quota system to determine how much oil to produce and sell. One of OPEC’s goals is to stabilize oil prices by eliminating unnecessary fluctuations. However, its decisions about production, pricing and distribution affect the price of international oil – and, consequently, the price of gasoline.Worldwide demand – The demand for crude oil in China, India and other developing countries has risen with their population, increased trade, growing internal markets and strong commodity prices. In less than five years, it is estimated that developing nations will account for nearly half of the global demand for oil, up from 36 percent in 1996.

Distribution network – Anything that interrupts the flow of petroleum through the distribution network can cause gas prices to rise, such as a natural disaster like Hurricane Katrina or political instability in major oil-producing countries like Venezuela, Iraq and Nigeria.

Value of the U.S. dollar – Oil is traded on the world market is U.S. dollars. When the value of the dollar declines in comparison to other major currencies, OPEC earns less per barrel of oil. To compensate, it may raise the price per barrel, thereby increasing the price of gasoline.

The market – One of the most complicated factors that affect gas prices is the oil trading market – actually, three different markets that all can play a role in the price of gasoline.

- Contract market – The fate of most oil and gas is predetermined by contracts among oil companies, dealers, refineries and independent dealers.

- Spot market – This market fills the gaps in the contracts market by matching companies with surplus oil to those that need more. Of the three markets, the spot market is the only one where actual barrels of oil are traded. It’s also where the best deals can be found because buyers and sellers are not bound by contracts. Thus, the laws of the free market are in effect.

- Futures market – Crude oil is traded on the New York Mercantile Exchange, although contracts are rarely fulfilled. For instance, while more than 5 billion barrels of oil were reportedly traded on the futures market during a seven-year period, only 31,000 were actually delivered. Regardless, the fluctuation in the price of oil per barrel is driven by information that represents the state of the oil market. In most cases, consumer gasoline prices will mimic the trends of the futures market.

Common misconceptions about gasoline prices

Perhaps the biggest misconception about gasoline prices is that gas companies set them. However, since the companies own only about 5% of U.S. stations, their control over the price at the pump is minimal.Another misconception is that gas stations like gas prices high. Not so. Profit margins at the pump are about 23 cents per gallon, regardless of the price per gallon. In addition, many stations are under contract to sell gas at a predetermined price, which may yield a profit of only a few cents on a dollar. And when gasoline prices increase, station owners feel the pinch because customers spend less on the store’s profitable convenience items.

Nice but you can also save your money with the help of discount coupons and coupon2deal offers you different types of discount coupons on different types of products like NordVPN Coupon, Namecheap Promo Code, Shein Coupon, hostinger Coupon.

ReplyDelete